tax per mile reddit

In 2017 this rate fell to 323 and remains there through the 2021 tax year. In 2022 the mileage allowance jumps to 585 cents per mile.

How To Calculate Cost Per Mile Optimoroute

The Indianapolis 500 consists of 200 25 mile laps.

.png)

. An impartial analysis of the 2022 measure in the official voter information guide said without the tax the fire protection district would lose. For the 2021 tax year that means 56 cents per mile gets taken off our earnings. September 18 2021 All-Electric Car Price Per Mile Comparison For US.

You can claim a deduction of 026 per mile. However many counties charge an additional income tax. 32 cents per gallon of regular gasoline and 53 cents per gallon of diesel.

Indiana has a flat statewide income tax. Shortly before the tax holiday expired in mid-April the average price for regular gas in the state was 369 per gallon. Where Can Taxes be Paid.

Review with your tax professional what you can deduct on your return including tax law changes for 2022. And then you remove other expenses such as your cell phone hot bags cell phone holders or any other expenses that are necessary and ordinary for the operation of your business. Carefulyou cant deduct both mileage and gas at the same time.

I make roughly 80k a year. Earned income tax credit. All-Electric Car Price Per Mile Comparison For US.

The standard mileage deduction 56 cents per mile in 2021 and 585 cents per mile in 2022 is calculated by the IRS to include the average costs of gas car payments maintenance car. If tax due dates fall on a Saturday Sunday or legal holiday the due date will be the immediately succeeding business date per MCL 21144a6 for summer taxes and MCL 21178a2 for winter taxes. As it turns out the standard mileage rate is pretty generous unless you drive a gas guzzler.

The 2021 standard mileage rate is 56 cents per mile and the 2022 rate is 585 cents per mile. February 24 2021 US most affordable BEVs per mile of range. Ie since the spinoff was 024 shares per 1 share my cost basis for T is reduced by the calculated cost basis of the new stock.

Option 2 is called the standard mileage deduction and it usually saves drivers more money at tax time than itemizing all car expenses. Click to share on Reddit Opens in new window Editorial Note. The longtime Newton attorney who served as an assistant US.

A nonresident alien filing Form 1040-NR cannot have a Married filing jointly or a Head of household filing status. The record for a single lap. Another way of deducting auto expenses is by keeping track of actual itemized expenses such as gas insurance and car payments and deducting the pro rata share used for business at the end of the year.

East Bay Charter Township 1965 N Three Mile Road Traverse City MI 49696 231-947-8647 Office Hours Monday - Thursday 700am - 530pm Website by Login. The standard mileage deduction is the simplest way to deduct business-related travel expenses with a rate of 56 cents per mile for 2021. As of Friday the price was 461 per gallon compared with a.

Attorney in the 1980s assistant state attorney general in the 1970s and per his law firm bio at one point a Boston College Law. If you qualify for the federal earned income tax credit you can claim this credit on your state return. Californias taxes are some of the highest in the US with a base sales tax rate of 725 and a top marginal income tax rate of 133.

Also ask them about the benefits of bunching your charitable deductions. Certain tax benefits such as the child tax credit the credit for other dependents and the additional child tax credit. The amount of the credit is 20 of your federal credit.

She spent her money frivolously - Parents knowledge of her past fiscal irresponsibility - Yes as it turned out when she was 16 they bought her a car with the agreement that shed pay for her gas and the insurance portion less than 100. Although the Golden State has high taxes it does play host to a number of bustling industries. And the premium tax credit for dependents are only available in full to residents of Canada and Mexico and to a limited extent to residents of.

So personally when calculating my cost basis for personal reasons not tax I consider a spinoff as a removal from total cost basis of original company. - Their income - She makes between 115-125k per year 7-10k take home a month.

The True Cost Of Car Ownership The Best Interest

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Do You Think The Dod Will Adjust The Pcs Mileage Rate On 1 July Right Now It S 0 18 Per Mile Which Is Not Enough To Cover My Drive I Saw In

Pay Per Mile Tax How Would It Impact You R Ukpersonalfinance

Gas Mileage Log And Mileage Calculator For Excel

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

The True Cost Of Car Ownership The Best Interest

What S Your Single Highest Paying Load Ever This Was Last Year No Touch Hhg From Denver Co To Norfolk Va Dod Contract 12k Lbs Dryvan 6 68 Per Mile On 1800 Miles R Truckers

The True Cost Of Car Ownership The Best Interest

The True Cost Of Car Ownership The Best Interest

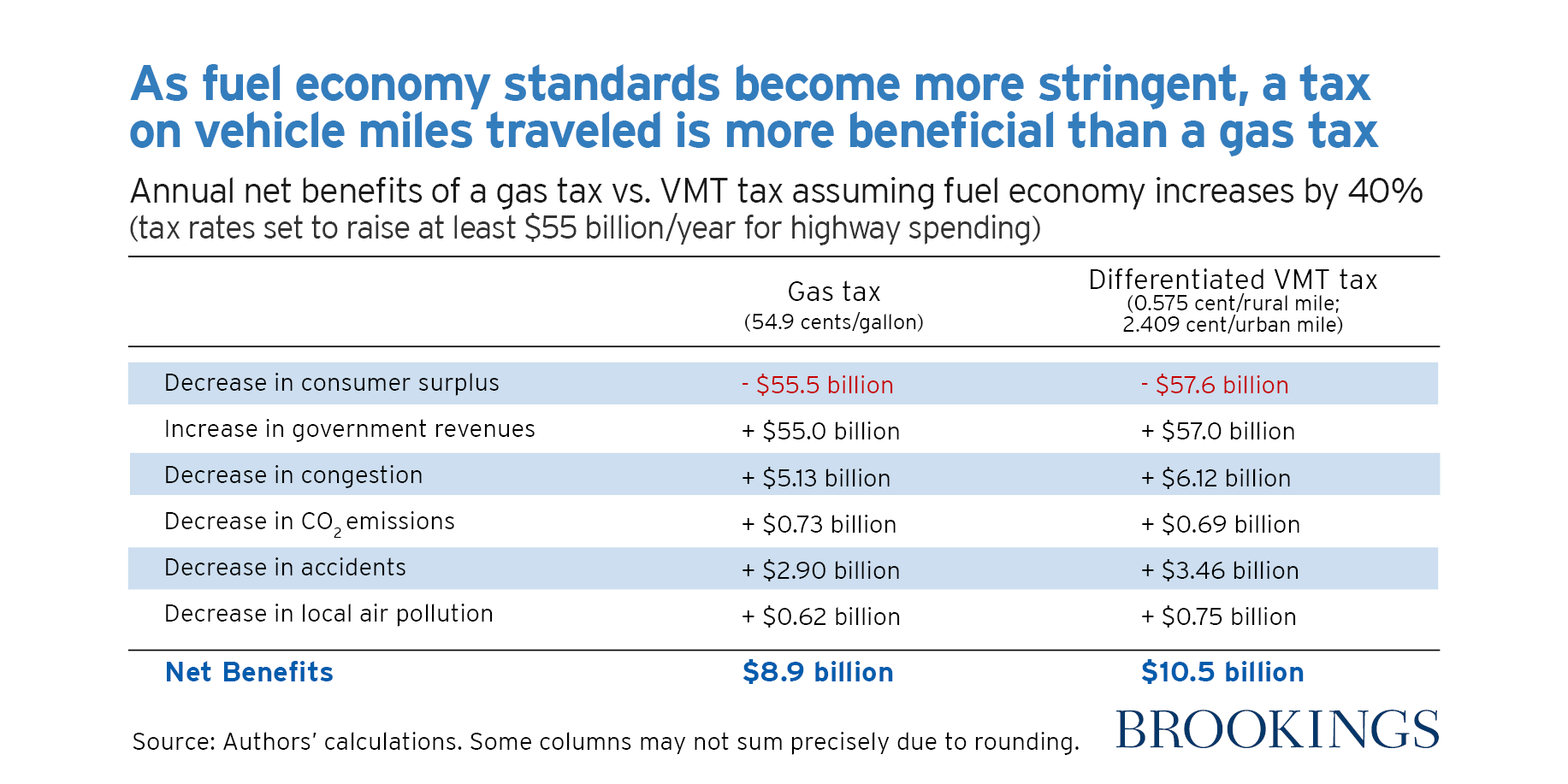

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

Government Looking To Tax Vehicles Per Mile In Future R Cartalkuk

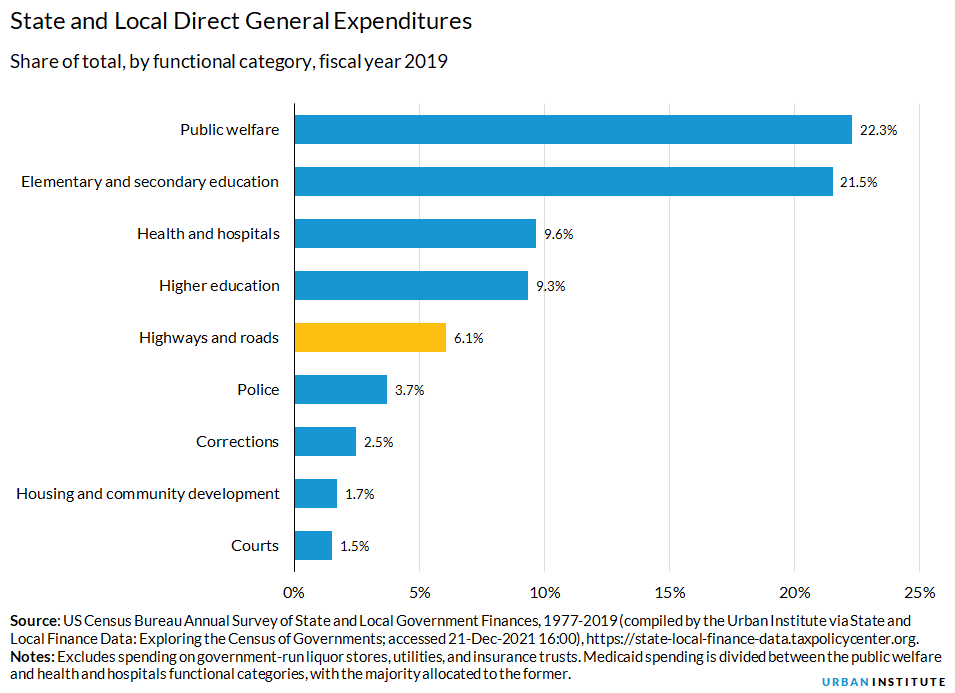

Highway And Road Expenditures Urban Institute

Infrastructure Bill Includes Per Mile Road Tax Test That Will Track Drivers Travel R Futurology